. . brings a decentralized and democratic economic platform to the real economy! . . brings a decentralized and democratic economic platform to the real economy! |

||||||||

|

Cloud Capital Chamber of Economies Cloudfunding CloudfundMe Buyers Crowd Sellers P2P Groups Places SignUp DeCom Markets FOMEZ GPEUN LED - Hubs GOMTX RingLink SODA FEV Outsourced Selling Engine UDC Smart Contracts DFDC UDI PriceDemand |

||||||||

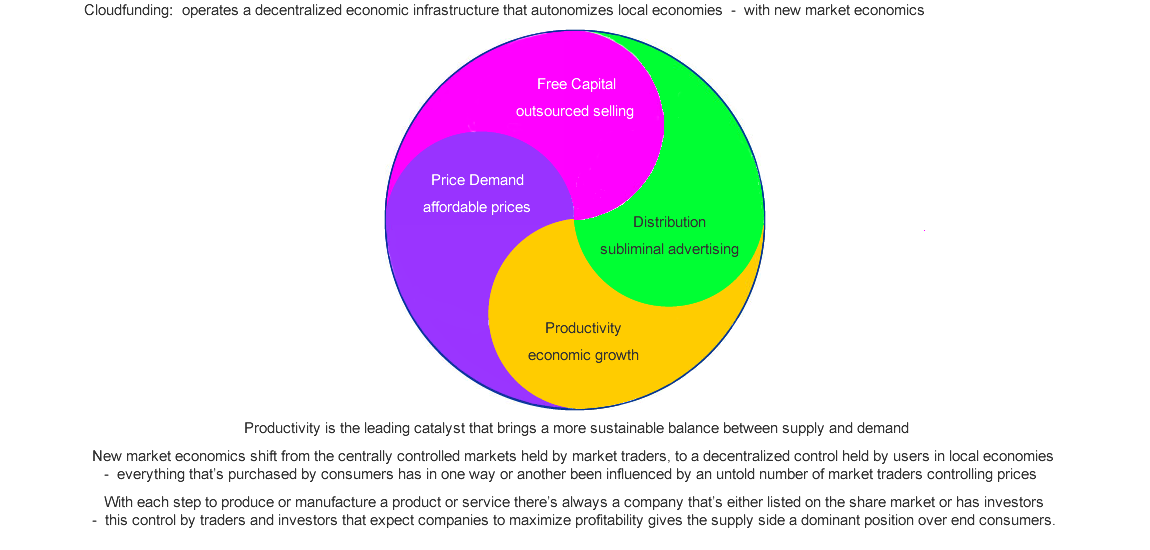

| Cloudfunding brings new market economics to local economies | ||||||||

|

||||||||

| . . Cloudfunding shifts control back towards the end consumer | ||||||||

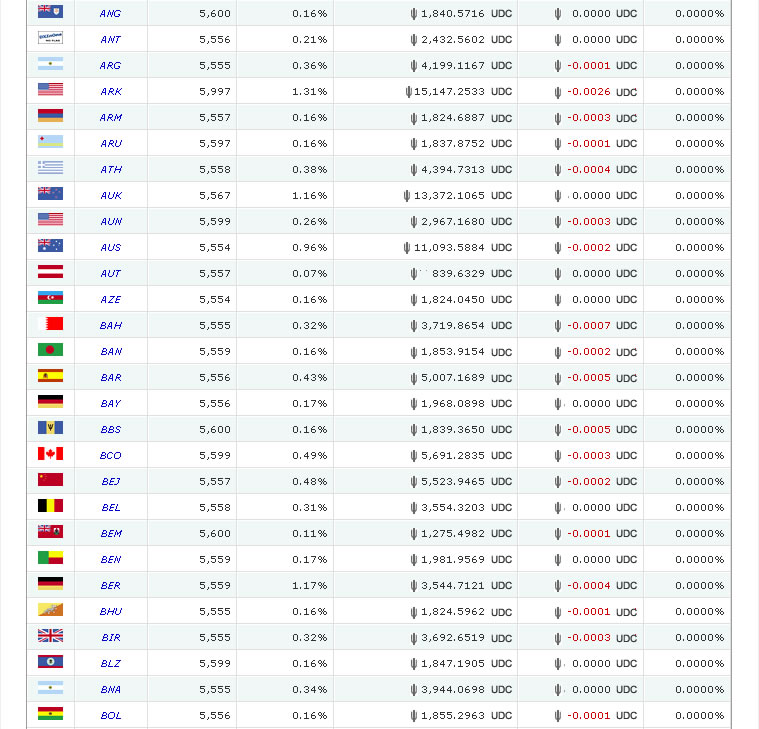

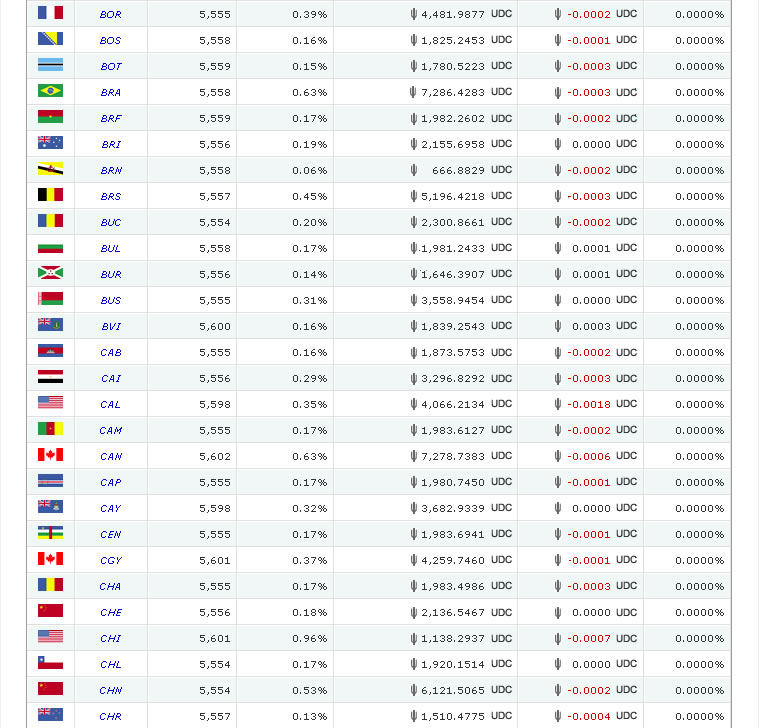

| Cloudfunding is an ecosystem with tools that give the end consumers in local economies the way to counter-balance control over end prices and profitability Users can gain from business and industries across a local economy just like a shareholder but with an added incentive to help drive productivity The performance of businesses and industries around environmental and social issues will have an enormous impact on local communities into the future These issues can be the deciding factors in how quickly inventory is processed by the global crowd and getting products and services out to the end buyers Businesses have the chance to showcase their company's environmental status with rating levels so the global crowd and buyers can judge for themselves Industries can set levels for their business members or individual businesses can set their own level of social good and get direct response for buyers To counter-balance the incentives between supply, where shareholders gain from profitable companies, and demand, where buyers only get discounts Cloudfunding use a location activity tax to distribute the productivity value back to users across the world, constantly building onto a user's stored value Universally Distributed Income portfolios give users direct connection with global locations where users can help drive productivity and then share in the new wealth With the more activity being generated with products and services being sold in real time, it offers users instant satisfaction on being a vital part of productivity Universally Distributed Income portfolios operate in real time, tracking and collecting a wealth tax on productivity being generated and distributed with the users This real time wealth sharing counter-balances the supply side that gives shareholders the benefit of share prices and dividends but take the risk of down trends UDI portfolios only have a linear growth where productivity is either positive or zero but not a negative value - this makes UDI portfolios an ideal storage utility Unlike shares in share markets, UDI portfolios are based on the overall location, which can be a city, region or country - each location has its own economy Each location is listed as a Symbol and includes all the commercial activity across all the various industries within the location zone operating on the platform The number of units available in a Location Token is uncapped, this allows strategies to influence productivity in a location, and not taking a quick advantage This means that as the productivity growth that gets displayed in real time and attracts users to increase the number of units, it decreases the share of wealth It provides the incentive to find locations where productivity can be driven by OMMs who can then gain a bigger share of the wealth growth being distributed |

||||||||

| Below is an example of a high-end portfolio - expand to see more Portfolios can begin with only a handful of Locations, which gains in real-time from the productivity in those locations |

||||||||

| Trend Activity l Location Screen l UDI Portfolio Summary l Portfolio Screen Summary l Portfolio Growth l Profile emore > | ||||||||

| Global Chamber of Economies - DeCom Markets Index | ||||||||

|

||||||||

more |

||||||||

| About Us Contact Privacy Policy Terms of Service |

||||||||