. . brings a decentralized and democratic economic platform to the real economy!

. . brings a decentralized and democratic economic platform to the real economy!Cloud Capital Chamber of Economies Cloudfunding CloudfundMe Buyers Crowd Sellers P2P Groups Places SignUp

FOMEZ GPEUN LED - Hubs GOMTX DOMIndex RingLink SODA FEV Economic Engine UDC Smart Contracts DFDC PriceDemand

Cloudfunding changes the dynamics in Commerce that have traditionally kept payments in parity between buyers and sellers, like when paying in cash where the seller receives 100% of what the buyer pays.

There's nothing wrong when there's an equal exchange, other than when a third party incumbent fits between to extract fees for using their system.

Cloudfunding solves the issue of when the demand side falls and the supply side begins to drop their prices to find the price that the demand side is willing to pay - it's the loss of economic value between the full selling price and the price the demand side accepts as the buying price, which negatively effects the local economy

- this discounted value is what Cloudfunding saves, and gets spent back into the local economies.

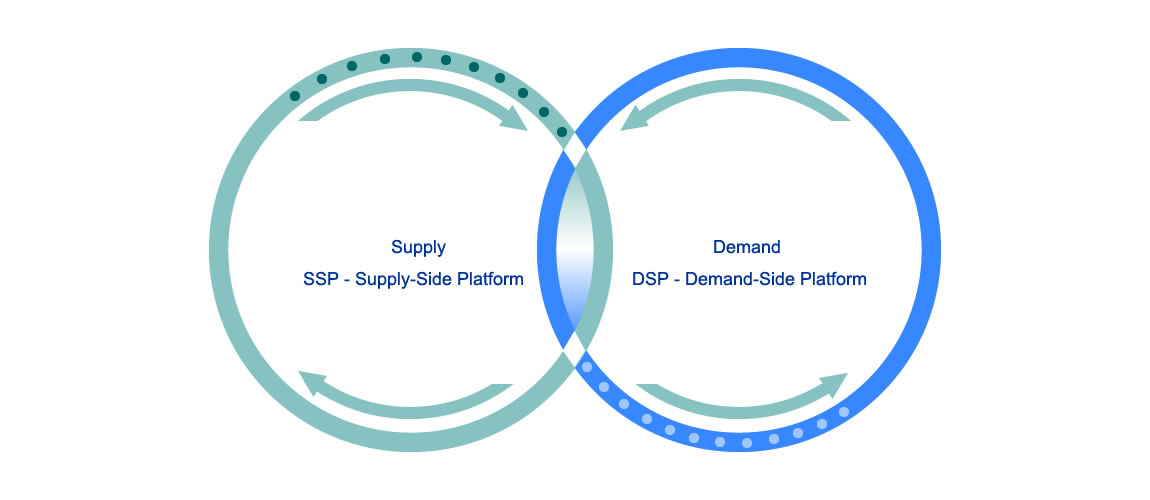

Cloudfunding separates the supply side from the demand side and incentivizes both sides where the sellers don't discount their full selling prices, while on the demand side the buyers benefit from cascading buying prices without affecting a seller's full selling price.

Where does the discounted value gap go?

Although seller discounting has been around since commerce began, it's become part of keeping turn-over going to overcome low sales revenue - the issue is that it has several levels, one is with competitors getting into the same strategy of following the discounting, and that's when it becomes the norm where buyers will delay buying and wait for the prices to fall.

Another compounding affect is that when discounting is used widely across a number of industries trying to gain revenue, there's a damaging affect on the tax income for governments, and flow-on revenues to suppliers and wages - this up and down boom and bust cycle is directly caused by the ungoverned use of credit that has been marketed during the last decades by banks for their own profit gain.

Credit is debt and when credit is simply created from nothing by banks it becomes addictive for banks wanting more profits to share between themselves and shareholders at the expense of borrowers, who have either borrowed for real estate or use credit cards for living expenses.

This debt burden is what Cloudfunding aims to solve with a new paradigm that operates autonomously, deleveraging user debt, without any link to legacy systems that's designed to dilute value from local economies and communities.

Demand

DemandLocal economies can be autonomous

The new economy needs a new narrative and new economic infrastructure to meet all the changes that the digital age has pushed into Commerce and Trade, that the old economy's legacy systems will not meet - Cloudfunding is focused on productivity and economic growth across borders for the transition to the new digital age.

It starts with new Capital flows of Free Economic Value / Cloud Capital / Cloudfunds, which's the economic value drawn from local economies and shared with global users, who can use it to build an independent income stream while helping to monetize local inventories - users have control over when they want to Op-In to collect FEV.

Free Economic Value - it's the Internet's Cloud Capital . . free working capital . . it's free to collect, has no interest or fees, and never needs to be paid back, ever!

While having free Capital flows generate economic growth and wealth, Cloudfunding provides a global distribution process that anyone can participate in to get a share of the generated wealth - this distribution of wealth to individuals via portfolios takes over the role of the old economic model of using inflation to drive growth across the increased cost of products and services - the wealth distribution across borders combats the lack of financial inclusion that leaves many societies behind - it's also a way of restricting the inflation of increased prices and the cost of living.

Where the old economy uses interest rates at delayed intervals that cause elasticity in the flows of capital that needs to flow efficiently to be fully productive - Cloudfunding uses algorithms to track the real demand price for products and services in real time as the inventories are released into the markets - this is where algorithms of the new economy will leave the centrally controlled economies behind with the caveman approach of using a club to hit things to get a result, instead of real time adjustments.

Cloudfunding use Global Productivity Index - GPI to track the prices paid in Price Demand real time, which determines the level of demand against the general market prices ( full shelf prices ), and judges if an increase in the GPI product and service prices is substantiated - the algorithms configure what full selling prices will generate the fastest velocity of movement of Capital in proportion to the level of spending in the economies, which in-turn maximizes the economic growth - instead of relying on sellers discounting or faking markets with interest rates and subsidizes or even diluting the value of local money by printing more.

Access to Capital in the New Economy

In the old economy where credit was the main way of gaining a product or service if cash money wasn't readily available - it would require needing to ask "Please sir, can I have some more!" - and it would be either easy when the banks wanted to give out credit or harder when banks didn't want to lend as much, and at various costs.

This restriction has been overcome by everyone having access to free economic value that users can continually collect and then use as free working capital to help drive productivity in the local economy, or in other economies around the world - this flow of Capital is what changes the landscape for users and local economies in the new economy, where no central control dictates the flow of Capital moving around in communities - it's all decentralized to allow a democratic consensus to control the flow of Capital being validated from the free economic value FEV working capital, into UDC, a Universally Decentralized Capital that users can spend on their lifestyle.

Having ongoing access to Capital can change the circumstances for everyone!

Contact

Privacy Policy

Terms of Service